Mastering Forex Trading Online Tips and Strategies for Success

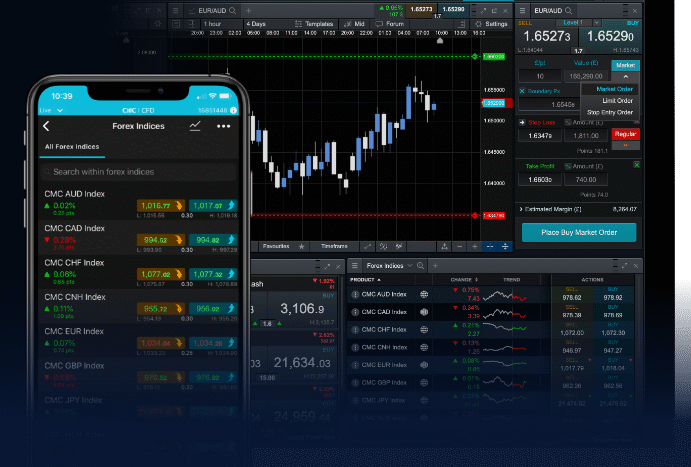

Forex trading online has become increasingly popular in recent years, as more individuals and institutional investors seek to capitalize on the volatility and liquidity of currency markets. With the advent of digital trading platforms and mobile applications, accessing forex trading has never been easier. If you’re looking to dive into this exciting market, forex trading online exbroker-turkiye.com offers valuable insights and resources to help you get started. In this article, we’ll explore essential tips, strategies, and pitfalls to avoid as you embark on your forex trading journey.

Understanding Forex Trading

Forex trading, or foreign exchange trading, involves the exchange of one currency for another in the global market. It operates on a decentralized market, meaning that trades occur over-the-counter, primarily via brokers or trading platforms. Unlike stock trading, which occurs on centralized exchanges, forex trading takes place 24 hours a day, five days a week, making it accessible to traders worldwide.

The Basics of Currency Pairs

Currencies are always traded in pairs, representing the exchange rate between two currencies. For instance, the EUR/USD pair indicates how many US dollars one euro can buy. Understanding the relationship between currency pairs is crucial for successful trading. Currency pairs are categorized into three types:

- Major pairs: Involves the most traded currencies, including EUR/USD, USD/JPY, and GBP/USD.

- Minor pairs: Consists of currencies that are less frequently traded, such as EUR/GBP and AUD/NZD.

- Exotic pairs: Involves a major currency paired with a currency from an emerging market, such as USD/TRY or EUR/PLN.

Choosing a Forex Broker

The selection of a reliable forex broker is critical to your trading success. When evaluating potential brokers, consider the following factors:

- Regulation: Ensure that the broker is regulated by a reputable authority, such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US.

- Trading platform: Review the trading platform’s features, ease of use, and whether it supports your trading strategies.

- Spreads and commission: Compare spreads and commission fees to determine the cost of trading with different brokers.

- Customer support: Assess the quality of customer support, including availability and responsiveness.

Technical Analysis in Forex Trading

Technical analysis is a crucial tool for forex traders, as it involves analyzing historical price data to forecast future price movements. Traders use various charts, indicators, and patterns to make informed decisions. Some essential tools for technical analysis include:

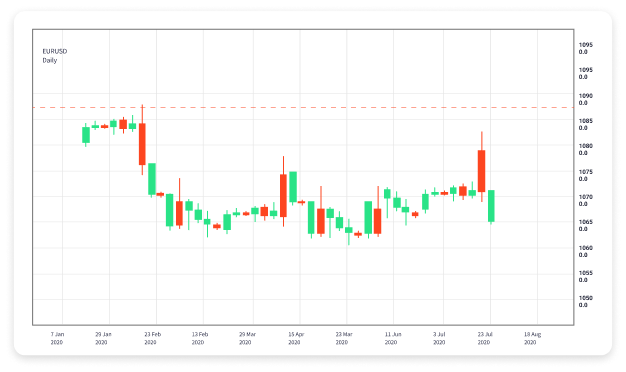

- Charts: Candlestick charts, line charts, and bar charts provide visual representations of price movements over time.

- Indicators: Tools like Moving Averages, Relative Strength Index (RSI), and MACD help traders identify trends, momentum, and potential reversal points.

- Chart patterns: Recognizing patterns such as head and shoulders, double tops, and triangles can provide insights into future price action.

Fundamental Analysis and Economic Indicators

While technical analysis focuses on price data, fundamental analysis looks at economic indicators and news events that influence currency values. Key economic indicators to watch include:

- Gross Domestic Product (GDP): Indicates the overall economic health of a country.

- Interest rates: Central banks set interest rates to control inflation and stabilize the economy.

- Employment data: Reports on unemployment and job creation can impact currency strength.

- Inflation rates: High inflation can erode currency value, while low inflation may lead to appreciation.

Developing a Trading Strategy

Establishing a comprehensive trading strategy is essential for success in forex trading. Your strategy should include:

- Risk management: Determine your risk tolerance and employ stop-loss orders to minimize potential losses.

- Entry and exit points: Identify specific criteria for entering and exiting trades based on your analysis.

- Trade size: Decide the number of lots to trade based on your account size and risk management approach.

Building a Trading Routine

Consistency is crucial in forex trading, which is why developing a daily trading routine can be beneficial. A typical routine may involve:

- Reviewing economic news and indicators relevant to your chosen currency pairs.

- Analyzing charts and making technical assessments.

- Executing trades based on your established strategy and documenting your decisions.

- Reflecting on the day’s trading outcomes and refining your approach.

Avoiding Common Pitfalls

As a new forex trader, it’s vital to be aware of common pitfalls that can lead to losses. Some mistakes to avoid include:

- Chasing losses: Avoid the urge to recover losses by risking more money on impulsive trades.

- Ignoring emotional discipline: Emotional trading can cloud judgment; stick to your strategy and avoid emotional decisions.

- Overleveraging: While leverage can amplify profits, it can also lead to significant losses, so use it wisely.

The Importance of Continuous Learning

The forex market is constantly evolving, and successful traders understand the importance of continuous learning. Keeping up to date with market trends, new strategies, and emerging technologies can help you stay competitive. Consider joining trading communities, attending webinars, and following reputable forex educators for ongoing knowledge and skills development.

Conclusion

Forex trading online presents a world of opportunities for individuals willing to invest time and effort into mastering the art of trading. By understanding the fundamentals, choosing the right broker, developing a strategic approach, and learning from your experiences, you can navigate the complexities of the forex market confidently. Remember, it takes time to become a successful trader, but with persistence and dedication, the rewards can be significant.

As you embark on your forex trading journey, always remain aware of the risks involved and trade responsibly. Whether you’re a beginner or an experienced trader, there’s always something new to learn in the dynamic world of forex.