Mastering Forex Currency Market Trading Strategies and Insights 1959063579

Mastering Forex Currency Market Trading: Strategies and Insights

The Forex currency market is one of the most dynamic financial markets in the world, with a daily trading volume exceeding $6 trillion. For traders looking to capitalize on the fluctuations of international currencies, understanding this vast market is crucial. In this article, we’ll delve into the strategies, tools, and insights that can help you navigate the complexities of Forex trading effectively. For traders seeking reliable platforms, forex currency market trading MT5 Forex Brokers offer robust resources and features.

Understanding the Forex Market

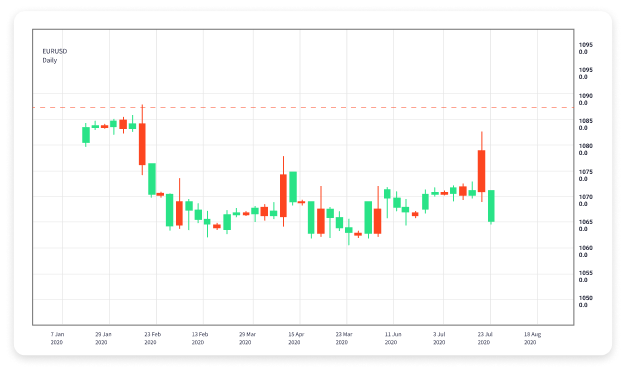

The Forex market operates 24 hours a day, five days a week, and is comprised of currency pairs that traders buy and sell. The primary currency pairs include the EUR/USD, USD/JPY, and GBP/USD, among others. Each currency pair indicates how much of the second currency is needed to purchase one unit of the first currency. The fluctuation of these rates is what traders capitalize on.

The Importance of Analysis in Forex Trading

Successful Forex trading requires rigorous analysis, which can be categorized into two main types: fundamental analysis and technical analysis.

1. Fundamental Analysis

Fundamental analysis involves evaluating a country’s economic indicators, such as gross domestic product (GDP), unemployment rates, interest rates, inflation, and political stability. Understanding how these factors influence currency values is essential. For instance, an increase in interest rates often attracts foreign capital, leading to the appreciation of the national currency.

2. Technical Analysis

Technical analysis focuses on past market data, primarily price charts, to predict future movements. Traders use various tools, such as trendlines, support and resistance levels, and indicators like moving averages and the Relative Strength Index (RSI), to identify entry and exit points.

Developing a Trading Strategy

Having a well-defined trading strategy is crucial for success in the Forex market. Here are some strategies that traders commonly implement:

1. Day Trading

Day trading involves opening and closing trades within the same trading session. Traders who adopt this strategy focus on short-term price movements and often rely on technical analysis to make quick decisions.

2. Swing Trading

Swing trading aims to capture gains within a set period, typically from several days to weeks. Swing traders use both technical and fundamental analyses to identify market trends.

3. Scalping

Scalping is a high-frequency trading strategy where traders make a multitude of trades throughout the day to profit from small price changes. Scalpers rely heavily on technical analysis and often use automated trading systems to execute trades quickly.

Risk Management in Forex Trading

Effective risk management is essential in Forex trading to protect your capital. Here are some risk management techniques:

1. Setting Stop-Loss Orders

A stop-loss order automatically closes a position when it reaches a certain level of loss. This helps to minimize potential losses and protect your trading capital.

2. Proper Position Sizing

Position sizing involves determining how much of your capital to risk on each trade. A common rule is to risk no more than 1-2% of your trading capital on a single trade, ensuring that you can survive a series of losses.

Utilizing Trading Platforms

The choice of trading platform can significantly impact your trading experience and results. It’s essential to select a platform that offers user-friendly interfaces, robust features, and tools that align with your trading style. Popular platforms include MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms provide extensive charting capabilities, technical analysis tools, and automated trading options.

The Psychological Aspect of Trading

Trading is not solely about numbers and strategies; psychology plays a significant role in trading success. Emotional discipline is vital, as it helps traders stick to their plans even when faced with wins or losses. Here are some psychological tips:

1. Control Your Emotions

Fear and greed can lead to impulsive decisions. By developing a disciplined mindset, you can make more rational trading choices.

2. Maintain Realistic Expectations

Forex trading is not a guaranteed path to wealth. Setting realistic goals and understanding that losses are part of the trading journey is necessary for long-term success.

Conclusion

Trading in the Forex currency market can be both challenging and rewarding. By focusing on thorough analysis, developing effective strategies, managing risk, and maintaining emotional discipline, traders can significantly improve their chances of success. Continuous learning and adaptation to changing market conditions are also essential to stay competitive in this ever-evolving market.

In summary, mastering the Forex market requires patience, practice, and a commitment to continuous learning. Utilize all the tools and resources at your disposal, including reliable platforms like MT5 Forex Brokers, to enhance your trading skills and forge a successful trading career.