Best Indicators for Forex Trading 1600811875

Best Indicators for Forex Trading

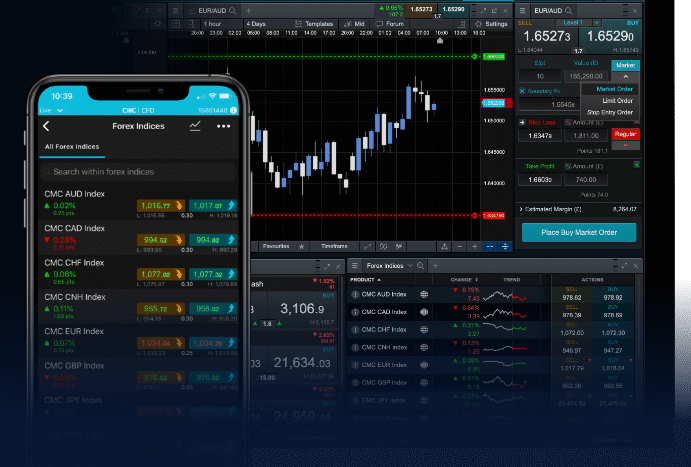

Forex trading is a dynamic and complex environment where investors seek to profit from fluctuations in currency values. To navigate this landscape effectively, traders rely on a variety of indicators that help them make informed decisions. In this article, we will explore some of the best indicators for forex trading that can enhance your strategy and improve your chances of success. If you’re looking to deepen your understanding of these tools, consider checking out best indicators for forex trading Trading Platform VN.

1. Moving Averages

Moving averages are perhaps one of the most commonly used indicators in forex trading. They provide insight into the overall direction of the market by smoothing out price data over a specified period. The two most popular types are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). Traders often use moving averages to identify potential support and resistance levels. For example, when the price crosses above the moving average, it might signal a potential upward trend, while a cross below could indicate a downward trend.

2. Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is typically used to identify overbought or oversold conditions in the market. An RSI above 70 indicates that an asset may be overbought, while an RSI below 30 suggests it may be oversold. This indicator can help traders identify potential reversal points, making it a valuable addition to any forex trading strategy.

3. Bollinger Bands

Bollinger Bands consist of a middle band (the moving average) and two outer bands that represent volatility. The distance between the bands increases or decreases based on market volatility. When the price approaches the upper band, it may be considered overbought, while touching the lower band could signal oversold conditions. Traders often use Bollinger Bands in conjunction with other indicators to confirm potential trading signals.

4. MACD (Moving Average Convergence Divergence)

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. Traders look for signal line crossovers and divergences as potential buy or sell signals. The MACD can help identify both the direction and strength of the trend, making it a versatile tool in any forex trading arsenal.

5. Fibonacci Retracement

Fibonacci retracement levels are popular among traders for identifying potential reversal levels. Based on the Fibonacci sequence, these levels indicate where the price might retrace before continuing in the original direction. By marking key Fibonacci levels, traders can set entry points, stop-loss orders, and profit targets, making it a powerful tool in technical analysis.

6. Stochastic Oscillator

The Stochastic Oscillator is another momentum indicator that compares a particular closing price of a currency pair to its price range over a specific period. The indicator generates a value between 0 and 100 and is typically used to find overbought and oversold levels. A value above 80 may indicate that a currency pair is overbought, while a value below 20 could indicate it is oversold. Traders often look for divergences between the stochastic indicator and the price to signal potential reversals.

7. Average True Range (ATR)

The Average True Range (ATR) is a volatility indicator that measures the degree of price movement over time. A higher ATR indicates higher volatility, while a lower ATR indicates lower volatility. This indicator is especially useful for traders looking to set stop-loss levels and determine position sizes. Knowing the volatility of a currency pair can significantly improve risk management decisions.

8. Ichimoku Cloud

The Ichimoku Cloud is a comprehensive indicator that provides information about support, resistance, trend direction, and momentum. It consists of five lines, and its unique visualization makes it easier to assess the overall market sentiment. While it may seem complex at first, understanding and applying the Ichimoku Cloud can offer profound insights into market dynamics and trading opportunities.

9. Average Directional Index (ADX)

The Average Directional Index (ADX) is designed to indicate the strength of a trend rather than its direction. It ranges from 0 to 100, with higher values indicating a stronger trend. Traders typically use the ADX alongside other indicators to determine whether to enter or exit trades based on trend strength. An ADX above 25 usually indicates a strong trend, while a value below 20 suggests a weak trend.

10. Economic Indicators

While technical indicators are essential, fundamental analysis plays a crucial role in forex trading. Economic indicators such as GDP growth rates, employment statistics, and inflation rates can significantly impact currency values. Staying informed about macroeconomic events and understanding how they affect currency pairs is vital for any successful forex trader. Many traders use economic calendars to keep track of upcoming reports and data releases.

Conclusion

In conclusion, the world of forex trading is intricate and requires a solid understanding of various indicators to make informed decisions. By incorporating moving averages, RSI, Bollinger Bands, MACD, Fibonacci retracement, the Stochastic Oscillator, ATR, Ichimoku Cloud, ADX, and economic indicators into your trading strategies, you can enhance your chances of success in the forex market. Each indicator has its strengths and weaknesses, so it’s essential to choose the right combination that suits your trading style and preferences. Always remember to combine technical analysis with sound risk management practices to safeguard your capital.